The Emergence of AI Agents in Banking for Loyal Customer Journeys

December 5, 2024

How AI Agents in Banking Will Transform the Industry Faster Than You Think

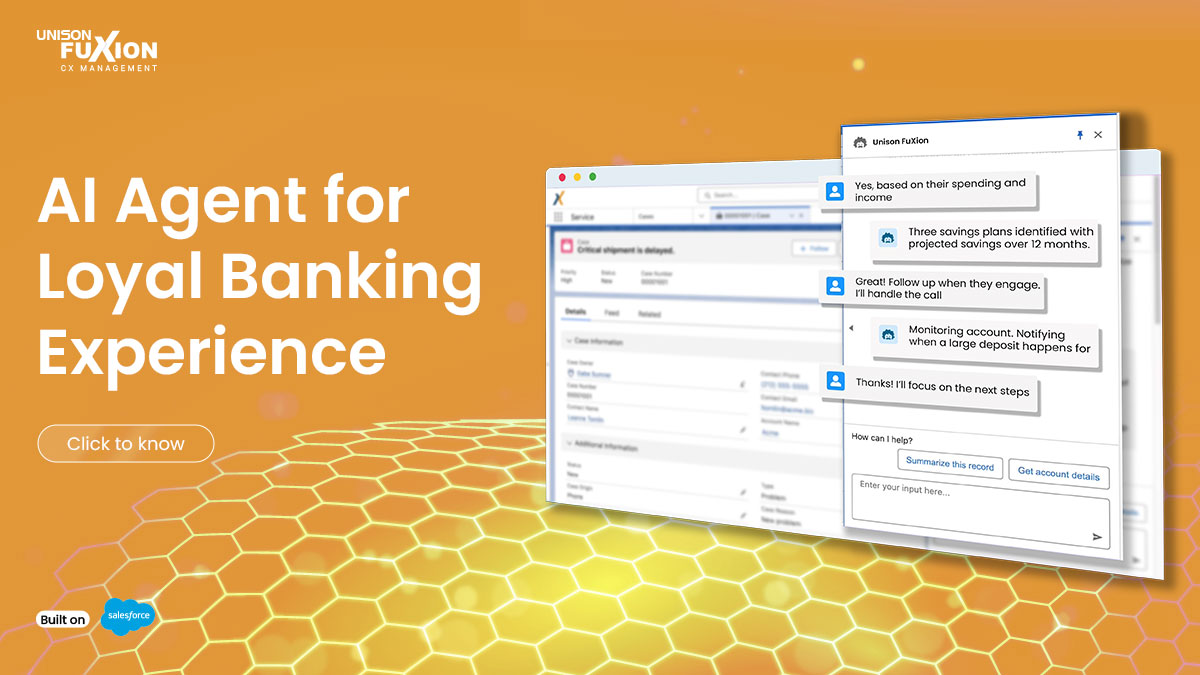

January 21, 2025AI Agents for Loyal Banking Experience: Revolutionizing Customer Journeys in the Banking Industry

As banks race to meet the ever-evolving demands of today’s digital-first customers, one powerful solution has emerged at the forefront of this transformation is AI-powered agents in banking. These intelligent systems are not just automating tasks; they are reshaping the entire customer experience, making it more personalized, efficient, and impactful than ever before.

In this rapidly changing landscape, customer loyalty is no longer won through traditional methods. It’s achieved through smart, data-driven engagement—something that only AI agents in banking excel at. But how can banks leverage AI agents in banking to ensure lasting relationships with their customers? The answer lies in the right technology that can seamlessly integrate customer data, service, and personalization.

That’s where Unison FuXion comes into play. The innovative equation of 24+ years of Avanza’s Banking CRM Expertise built on Salesforce’s #1 Technology Platform for Intelligent Customer Journeys. Unison FuXion is the synergy of experience and technology, offering the perfect equation for innovation using CRM, data, and AI—all built to seamlessly connect with customers, capture valuable insights, and convert every interaction into lasting relationships.

Unison FuXion, the next-generation customer banking experience suite designed to transform how

About Unison FuXion

banks interact with their customers, from driving engagement to creating seamless, automated

processes. By enabling hyper-personalization and continuous service, Unison FuXion with

autonomous capabilities helps banks to meet and exceed customer expectations, ensuring long-term

loyalty and satisfaction.

This article delves into the pivotal role AI agents in banking play in fostering customer loyalty in the banking industry, with a spotlight on how Unison FuXion is making these advancements a reality for banks today.

1. The Growing Need for AI Agents in Banking

In the past decade, the banking industry has undergone a dramatic transformation, driven largely by technological advancements. From mobile banking apps to chatbots, the rise of AI technology has fundamentally changed how banks interact with their customers. A 2021 report by Accenture reveals that 70% of banking customers prefer interacting with AI-based systems rather than waiting for a human agent. This shift is a direct result of consumers’ increasing demand for speed, convenience, and personalization.

However, despite these innovations, many banking systems still struggle with slow service, missed opportunities, and disconnected data, leading to frustrated customers. According to a study by PwC, 59% of customers say that timely communication is the most important factor in a good customer experience. This highlights the pressing need for banks to adopt AI agents capable of delivering swift, personalized service at scale.

With AI agents, banks can now handle large volumes of customer interactions, automate routine tasks, and offer real-time insights that drive smarter decision-making, all while delivering exceptional, personalized experiences that build trust and loyalty.

2. How AI Agents in Banking Foster Long-Term Customer Loyalty

AI agents in banking are revolutionizing customer experiences by enabling hyper-personalized services and operational efficiencies that improve overall service quality. Here are some of the key benefits AI agents in banking bring to the industry:

Enhanced Customer Experience through Personalization

AI agents excel at leveraging data analytics to understand customer preferences and deliver highly personalized banking experiences. By analyzing transaction history, spending habits, and engagement patterns, AI agents in banking can tailor offers, recommendations, and financial advice to meet individual customer needs.

Unison FuXion utilizes AI agents to personalize every interaction, providing customers with customized advice on savings, investments, and loan products. This level of personalization increases customer satisfaction, enhances trust, and fosters long-term loyalty.

Increased Efficiency and Reduced Costs

AI agents in banking can automate routine tasks such as balance inquiries, fund transfers, and bill payments, significantly reducing the workload for human employees. This leads to cost savings for banks and shorter response times for customers. AI agents in banking also handle multiple inquiries simultaneously, eliminating the need for customers to wait in queues or for human agents to respond.

A McKinsey report on AI in banking found that AI agents can reduce operational costs by 30-40%, a crucial advantage for banks looking to optimize efficiency and enhance profitability.

24/7 Availability for Customer Support

One of the most significant advantages of leveraing AI agents in banking is their ability to provide around-the-clock service, ensuring that customers have access to support at any time, even during holidays or after business hours. AI agents are not bound by time zones or shift limitations, ensuring that customers receive immediate responses to their inquiries, regardless of when they reach out.

Banks that integrate Unison FuXion, can ensure that 24/7 support becomes the norm, providing unparalleled convenience for customers and boosting satisfaction rates.

Faster Response Times for Service Requests

Speed is a crucial factor in customer satisfaction, and Unison FuXion ensures that service requests are handled efficiently, reducing waiting times and enhancing overall service quality. AI in banking excels at handling requests quickly. By instantly analyzing data and using predefined algorithms, Unison FuXion’s AI agents in banking can resolve both common issues and more complex requests swiftly, ensuring that no customer query goes unresolved.

Real-World Applications of AI Agents in Banking

Banks worldwide are increasingly integrating AI agents into their operations to deliver superior customer experiences and drive loyalty. Here are some real-world examples of how AI-powered solutions are transforming the banking sector:

Chatbots and Virtual Assistants

Many leading banks have adopted AI-powered chatbots and virtual assistants to streamline employee tasks. These AI agents help banking staff by providing instant answers to frequently asked questions, guiding employees through complex processes, and assisting with routine tasks like data entry and customer account management, allowing staff to focus on more strategic activities.

Unison FuXion’s AI agents in banking CRM assist banking employees by providing real-time financial insights, automated bill payment reminders, and tailored recommendations based on customer data. This AI-driven support empowers staff to engage with customers proactively, streamline workflow, and offer personalized solutions, ultimately improving efficiency and boosting the adoption of digital banking services.

Predictive Analytics for Personalized Offers

Unison FuXion’s AI agents leverage predictive analytics to identify cross-selling and upselling opportunities by analyzing customer behavior. By predicting customer needs, such as loans or mortgages, AI agents deliver tailored services at the right time, enhancing customer experience and driving revenue growth.

Automating Routine Transactions and Enhancing Security

AI agents in banks help to automate routine transactions, such as fund transfers, bill payments, and balance inquiries, reducing the time and effort required by both customers and staff. AI also helps enhance security by analyzing transaction patterns and flagging any potentially fraudulent activities in real-time.

Unison FuXion has an integrated AI fraud detection system, allowing the bank to identify suspicious transactions within seconds, ensuring that customers’ accounts are protected and minimizing fraud risk.

The Future of AI Agents in Banking

As AI technology continues to evolve, the role of AI agents in banking is expected to expand even further. Banks are exploring advanced capabilities such as voice-activated banking and machine learning models that can anticipate customer needs more accurately than ever before.

AI agents in banking will continue to evolve into more intelligent systems capable of providing personalized financial advice, managing complex transactions, and improving customer loyalty. In the coming years, AI agents will play an even more significant role in shaping the customer journey, helping banks stay competitive in an increasingly digital and customer-centric world.

Why Unison FuXion Is the Ideal Solution for AI-Powered Banking

Unison FuXion stands out as the ultimate solution for integrating AI-driven agents into the banking experience. Built on Salesforce’s powerful platform and backed by Avanza Solutions’ decades of banking expertise, Unison FuXion combines cutting-edge AI technology with a robust CRM system. This enables banks to deliver personalized, efficient, and seamless customer experiences, positioning Unison FuXion as the leading solution for modern banking needs. With Avanza Solutions’ deep industry knowledge, every workflow in Unison FuXion ensures that banks stay ahead of the curve in enhancing customer loyalty and operational efficiency. Here’s why Unison FuXion is the go-to solution for banks:

- AI-Powered Personalization: Unison FuXion’s AI agents provide a 360-degree view of each customer, allowing banks to deliver tailored interactions based on individual preferences and behaviors.

- Seamless Integration: Built on Salesforce, Unison FuXion seamlessly integrates with your bank’s existing systems, ensuring smooth communication between departments and streamlined operations.

- Advanced Analytics: With built-in data analytics, Unison FuXion helps banks identify customer trends, predict future behaviors, and offer data-driven solutions to enhance engagement and revenue.

- Scalability: Whether you’re a small community bank or a large financial institution, Unison FuXion is scalable and can grow with your business, ensuring that you stay ahead of the competition.

Think Ahead

AI agents are revolutionizing the banking industry, delivering faster, more personalized services while enhancing operational efficiency. With Unison FuXion, banks can directly boost customer loyalty, increase revenue, and streamline operations. Unison FuXion seamlessly integrates AI agents into banking processes, leveraging Salesforce’s industry-leading CRM technology to stay at the forefront of the banking revolution. By adopting Unison FuXion, banks can provide exceptional customer experiences and maintain a competitive edge in this ever-evolving industry. Unison FuXion isn’t just a tool—it’s the key to transforming the way banks engage with their customers and thrive in the future of banking.

Ready to unlock the full potential of AI agents in banking? Explore how Unison FuXion can transform your bank’s customer engagement today.