AI Agents for Loyal Banking Experience: Revolutionizing Customer Journeys in the Banking Industry

December 19, 2024

AI Agents are Transforming Banking Sector in 2025

February 6, 2025The banking industry stands on the brink of a transformation unlike anything it has seen before. While digital innovation has reshaped customer expectations, many banks remain stuck in the gap between ambition and execution. Despite pouring billions into technology, challenges such as inefficiency, rising customer dissatisfaction, slowing revenue growth, and fierce competition from fintech and neobanks persist. In this rapidly evolving landscape, the question is no longer whether Artificial Intelligence (AI) will impact banking—but how soon it will redefine the industry entirely.

For many decision-makers, the road ahead is filled with critical questions:

- Can AI move beyond pilots and small-scale projects to solve systemic problems?

- How can banks ensure measurable returns on their AI investments?

- What does true transformation look like in a world where customer expectations evolve faster than ever?

The answer lies in rethinking workflows with AI agents in banks, that promise to revolutionize critical areas like customer engagement, operational efficiency, and workforce productivity. For banks to truly capitalize on the power of AI, the journey must go beyond experimental pilots and basic automation.

The answer lies not in fragmented experiments but in reimagining the entire customer experience through AI agents in banking—the best version of the banking customer experience management suite that has the potential to eliminate inefficiencies, personalize every interaction, and streamline even the most complex workflows.

Imagine this: a banking experience where long wait times are a thing of the past, customer needs are anticipated before they’re voiced, and operational bottlenecks are transformed into opportunities for growth. This isn’t just a technological upgrade—it’s a paradigm shift, and it’s happening now.

At the heart of this transformation is Unison FuXion, a groundbreaking Salesforce-based customer experience management suite that integrates AI agents, CRM, and data intelligence into one seamless platform. Unison FuXion goes beyond simple automation by embracing the true power of AI in banking to potentially drive meaningful change across every aspect of banking, from enhanced customer personalization to improved operational processes, enabling banks to not only solve today’s challenges but also future proof their work functions against the ever-changing landscape of financial services.

Brief Overview of the Banking Industry’s Challenges

The banking industry is facing unprecedented pressure in today’s digital-first world. While financial institutions have historically operated under a set of traditional systems, customer demand for speed, personalization, and efficiency is changing the game. Banks are now expected to deliver immediate, seamless experiences across every touchpoint, whether it’s on mobile apps, websites, or in person.

Today, they need to evolve from basic AI trials to fully AI-integrated banking solutions that continuously adapt to market needs, customer behaviours, and the rapidly changing landscape of the financial sector. Because AI isn’t just about keeping up—it’s about leaping ahead. By leveraging Unison FuXion’ integrated AI agents, banks can reimagine their workflows, enhance customer experience, and achieve an efficiency that was once thought impossible.

Current AI Adoption Rates in Banking

AI is no longer a futuristic concept in the banking industry. According to a PwC report, 52% of financial services companies had adopted AI technologies by 2023, with an additional 31% planning to do so in the next few years. In particular, AI is being integrated into various banking operations such as customer service (via AI-powered chatbots), fraud detection, risk management, and customer relationship management (CRM).

Here’s a brief table showing the current AI adoption rates and expected trends in banking:

| Technology Area | Current Adoption (%) | Future Adoption (%) |

| Customer Service AI (Chatbots, Virtual Assistants) | 50% | 80% |

| AI for Fraud Detection | 45% | 75% |

| AI for Personalization | 35% | 65% |

| AI in Risk Management | 40% | 70% |

As AI adoption grows, it is clear that AI agents are positioned to be the catalysts that will shape the future of banking by enhancing customer experience and business operations.

Key Drivers for AI Implementation in Banking

The primary motivations for integrating AI in banking are to enhance operational efficiency, improve risk management, and meet the growing demand for personalization in banking experiences. According to Ernst & Young, 52% of financial institutions are generating new revenue streams through AI-powered banking solutions, showcasing the transformative potential of this technology. Several critical factors are driving the adoption of AI agents in banking:

- Cost Reduction and Operational Efficiency: By automating routine tasks such as processing customer inquiries, handling transactions, and conducting basic risk assessments, AI-powered banking solutions significantly reduce operational costs while improving service delivery.

- Enhanced Customer Experience and Personalization: Leveraging AI in banking, financial institutions can analyze vast amounts of customer data to predict needs and deliver personalization in banking services. This tailored approach fosters higher customer satisfaction and loyalty.

- Improved Risk Management and Fraud Detection: AI agents in banking excel at detecting fraudulent activities by analyzing patterns and identifying anomalies in real-time, providing an extra layer of security for financial operations.

- Regulatory Compliance and Reporting: AI simplifies compliance by automatically monitoring transactions and generating reports that align with ever-evolving regulations, ensuring banks remain compliant without added manual effort.

- Competitive Advantage in a Digital-First Market: As fintechs continue to innovate, AI-powered banking solutions enable traditional banks to deliver modern, digital-first experiences that resonate with tech-savvy customers, ensuring they remain competitive in an increasingly digital landscape.

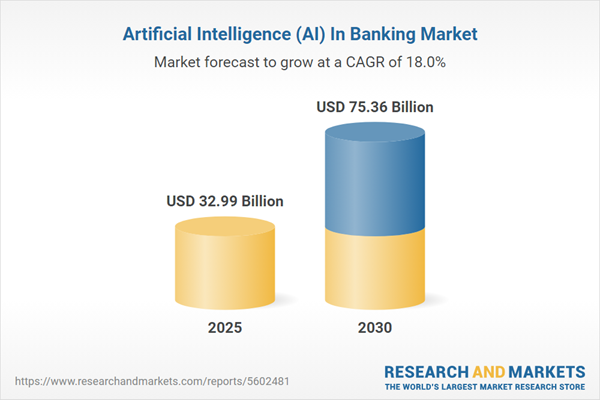

Projected Growth and Market Size

The global AI in banking market is expected to grow substantially, reaching an estimated market size of USD 64 billion by 2025, growing at a compound annual growth rate (CAGR) of 23.5% from 2020. This significant growth is attributed to banks investing in AI technologies that can provide smarter, faster, and more efficient services.

Importance of Customer Experience in Banking

Customer experience is at the core of today’s competitive banking environment. As highlighted by Gartner’s report, 89% of businesses expect to compete primarily on customer experience by 2025. In the past, banking relationships were more transactional, but in the digital age, customers are seeking seamless, personalized experiences. AI is the key to delivering these experiences, from personalized banking suggestions to real-time support through virtual assistants.

Thesis Statement

AI agents are poised to revolutionize the banking sector by enhancing customer experience, boosting operational efficiency, and transforming how banks engage with their customers. With the rise of Unison FuXion, an AI-powered customer experiences management suite, banks now have a powerful tool to accelerate their digital transformation, addressing the industry’s pain points and leading them into the future of banking.

The Current State of Banking

Overview of Traditional Banking Systems

Many banks still use outdated core banking systems that hinder their ability to innovate and remain competitive while they have been heavily reliant on manual processes and legacy systems, which have limited their ability to scale and adapt to the fast-paced demands of the modern banking environment. These systems often operate in silos, with data and services isolated across different departments. This lack of integration makes it difficult to offer personalized services and create a seamless customer journey.

The key to success in 2025 and beyond lies in answering the questions about real ROI, cost management, and how to harness AI for long-term transformation. While many banks are still catching up with AI technology, Unison FuXion offers an advanced customer experience management suite that not only addresses the industry’s pain points but helping banks to not only survive in a competitive environment but thrive by AI driven innovations, reducing costs, and improving overall banking service quality.

Customer Pain Points

Common issues faced by banking customers include prolonged wait times for service, inefficient customer support, and a lack of personalized banking solutions. These pain points contribute to a disconnect between banks and their clientele.

Customer Loyalty At Risk

Despite some positive feedback, there are notable areas of concern. A study by the XM Institute found that while 84% of banking consumers are satisfied with their experience getting help from customer service, this is the lowest satisfaction rate among ten evaluated journeys, indicating that customer service falls short of expectations.

Based on research from J.D. Power’s 2024 U.S. Retail Banking Satisfaction Study reports that 8% of retail bank customers have changed their primary bank, up from 5% in 2018, suggesting a growing willingness to switch due to dissatisfaction.

The Rise of AI in Banking

AI agents are revolutionizing how banks interact with their customers by tackling inefficiencies, improving customer experience, and reducing operational costs. Unison FuXion, a Salesforce-based customer experience management suite, stands out as a leader in this revolution by integrating AI-powered agents to offer a personalized, efficient, and seamless banking experience. By automating routine tasks and enhancing the quality of customer service, Unison FuXion empowers banks to serve their customers more effectively while reducing costs and operational inefficiencies.

Unlike generic banking experience solutions, Unison FuXion offers a comprehensive suite tailored to banks’ unique challenges, ensuring seamless integration and maximum ROI.

The Key Capabilities and Next-Gen Features of Unison FuXion

AI-Driven Personalization and Insights

Unison FuXion uses AI to offer hyper-personalized services, ensuring customers feel valued and understood. From tailored financial advice to predictive analytics, this feature elevates customer engagement.

Unified Customer Insights

Data silos are a significant obstacle in traditional banking systems. Unison FuXion’s unified platform ensures that all customer information is accessible in one place, enabling informed decisions across departments.

Service Bus Integration for Seamless Operations

Unison FuXion integrates with legacy systems via Avanza’s proprietary Service Bus, facilitating smooth data exchange and reducing implementation friction.

Process Automation and Business Productivity

AI agents streamline complex workflows, such as compliance checks and transaction monitoring, enhancing productivity across the organization.

Why Unison FuXion is the Best Salesforce CRM for the Banking CRM Industry

The integration of Unison FuXion along with AI in banking brings several key benefits:

- Improved Efficiency: AI-powered systems can handle a wide range of tasks—from answering customer queries to processing transactions—leading to quicker resolutions and reduced workload for human employees.

- Enhanced Customer Experience: AI agents in Unison FuXion can engage with customers across various touchpoints (mobile, chat, email), ensuring consistent and personalized interactions.

- Reduced Costs: By automating routine tasks, AI helps banks reduce operational costs while improving the quality of service.

- Sales Optimization & Market Opportunities: AI agents in Unison FuXion can analyze customer behavior and preferences, helping banks cross-sell products and increase revenue.

- Process Automation & Business Productivity: AI automates tasks like document verification, loan processing, and account management, streamlining business processes and boosting productivity.

- Service Quality Excellence: AI enhances customer service quality by providing accurate, fast, and consistent responses across all channels.

- One-Window Solution: AI provides a unified, holistic view of customer interactions, enabling banks to offer seamless, integrated services.

Benefits of Unison FuXion AI in Banking

- AI-Driven Personalization: Tailored experiences for each customer based on behaviour, history, and preferences.

- Omnichannel Integration: AI-powered solutions that provide consistent support across multiple channels (web, mobile, voice, etc.).

- Advanced Analytics: Real-time insights into customer behaviour and needs, driving better decision-making.

- Automated Workflows: Streamlining back-office operations to reduce costs and improve efficiency.

Transforming Customer Experience with AI Agents in Banks

AI agents have the potential to revolutionize customer experience in banking in three key ways: personalization, proactive support, and real-time engagement.

Personalization: AI agents can offer highly personalized banking experiences. By analyzing vast amounts of data, AI systems can identify patterns and preferences, allowing banks to provide tailored recommendations, promotions, and solutions. For example, AI can recommend financial products based on a customer’s spending habits or offer personalized financial advice based on their savings goals.

Proactive Support: AI agents don’t just react to customer queries; they can proactively offer support. For example, an AI agent could identify when a customer struggles with an online banking interface and proactively offer assistance or guide them. This level of engagement can significantly improve customer satisfaction and loyalty.

Real-Time Engagement: One of the key benefits of AI agents is their ability to provide real-time support. Whether it’s answering customer questions, completing transactions, or providing updates on the status of a loan application, AI agents can deliver responses instantly, helping banks reduce wait times and improve overall service efficiency.

Several banks have already successfully implemented AI-powered solutions. For example, Bank of America’s virtual assistant, Erica, helps customers manage their finances by providing personalized financial advice, monitoring spending patterns, and offering real-time assistance. Similarly, Wells Fargo’s AI-powered chatbot, named ‘Fargo,’ provides 24/7 customer service and supports various banking functions.

Unison FuXion: The Ultimate Customer Experience Management Suite

While AI-powered solutions like Erica and Fargo are transforming customer experience, Unison FuXion is the ultimate customer experience management suite for the banking industry. Built on the Salesforce platform, Unison FuXion combines AI agents with a powerful CRM system to help banks deliver smarter, more efficient customer experiences.

Unison FuXion is designed specifically for the banking industry, offering a seamless integration of AI, data, and CRM technology. The suite provides a range of tools for improving customer engagement, streamlining operations, and enhancing service delivery. Some of the key features of Unison FuXion include:

- Personalized Banking Experiences: By leveraging AI and data analytics, Unison FuXion enables banks to deliver personalized, relevant experiences to each customer, improving engagement and satisfaction.

- Real-Time Customer Support: Unison FuXion’s AI agents can provide instant, real-time support, ensuring that customers receive prompt and accurate responses to their queries.

- Operational Efficiency: The platform automates routine tasks, reducing the workload on human agents and improving overall operational efficiency.

- Seamless Integration: Unison FuXion seamlessly integrates with existing banking systems, ensuring that banks can implement AI-powered solutions without disrupting their operations.

Implementation and Integration of AI Agents in Bank

Implementing AI-powered customer experience solutions in banking requires careful planning and integration with existing systems. Here are the key steps involved in integrating Unison FuXion into a banking environment:

- Assessing Needs: Banks must first assess their current systems and identify the areas where AI can provide the most value. This could include customer service, account management, fraud detection, or other operational areas.

- Choosing the Right AI Solution: After assessing their needs, banks should select an AI solution that aligns with their business objectives. Unison FuXion is specifically designed for the banking industry and offers a comprehensive suite of tools for improving customer experience.

- Integration with Existing Systems: One of the key benefits of Unison FuXion is its ability to seamlessly integrate with existing banking systems, including CRM platforms, core banking systems, and customer service tools.

- Training and Support: To ensure successful implementation, banks should invest in training staff to work with the new AI tools and provide ongoing support to address any issues that may arise.

- Continuous Optimization: AI-powered solutions improve over time as they collect more data and refine their algorithms. Banks should continuously monitor and optimize their AI systems to ensure they deliver the best possible customer experience.

Conclusion

The banking industry is undergoing a rapid transformation, and AI agents are at the heart of this revolution. By leveraging AI technology, banks can provide personalized, real-time customer experiences that drive loyalty and satisfaction. Unison FuXion is the ultimate customer experience management suite for banks looking to embrace the power of AI and stay ahead of the competition.

As the banking industry continues to evolve, AI agents will play an increasingly important role in enhancing customer service, improving operational efficiency, and driving revenue growth. By implementing AI-powered solutions like Unison FuXion, banks can ensure they are ready for the future of banking.

Think Ahead: Future Trends in AI-Powered Banking

As AI technology continues to evolve, the potential for innovation in banking is limitless. In the future, AI agents in banks may become even more sophisticated, offering deeper levels of personalization, greater predictive capabilities, and more seamless integration with other digital services. Banks that adopt AI now will be well-positioned to lead the way in the future of banking.

Unison FuXion is not just a solution for today’s banking challenges—it’s a future-ready AI-powered customer experience management suite for tomorrow’s opportunities. By embracing AI agents in banking, financial institutions can stay ahead of the curve and deliver exceptional customer experiences that will define the industry’s future.

Key Takeaways:

- AI agents in banking are transforming customer experience, improving efficiency, and reducing costs.

- Unison FuXion is the ultimate AI-powered solution for managing customer experience in banking.

- Implementing AI solutions requires careful planning, integration, and continuous optimization.