The Future of Digital Banking: 6 Trends Shaping 2025 and Beyond

May 30, 2025

Avanza Solutions proudly announces its official partnership with Salesforce, the world’s #1 CRM platform

September 24, 2025Why Compliance is Critical in Modern Digital Banking

Financial institutions are under pressure to meet evolving regulations while delivering digital-first services. From onboarding to transactions, compliance requirements now span across the full customer lifecycle.

Failing to meet standards like KYC (Know Your Customer), AML (Anti-Money Laundering), GDPR, and PSD2 can lead to massive penalties. But beyond fines, non-compliance damages customer trust and market reputation.

Regulators are increasing scrutiny, especially as cyber threats and fraud rise in digital channels. Even small fintech players must show that their systems are secure and traceable.

Compliance is no longer just a legal checkbox—it’s a business necessity. Maintaining up-to-date compliance ensures risk mitigation, audit readiness, and brand resilience. It also boosts user confidence and supports long-term customer loyalty.

In a competitive digital landscape, financial firms that embed compliance into the platform architecture gain a distinct edge. Compliance is not just a back-office function. It’s integral to UX, product strategy, and customer satisfaction.

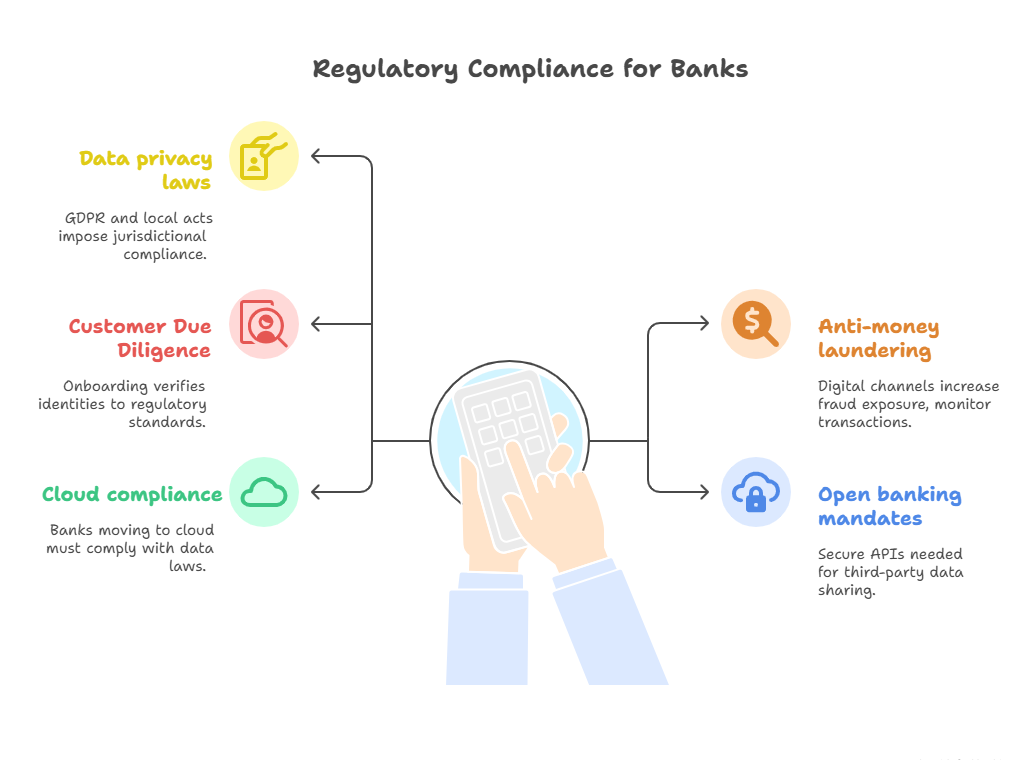

Major Regulatory Challenges Banks Must Address

Modern banks must navigate an expanding web of regulatory requirements. Key areas of concern include:

New entrants and traditional banks alike struggle to adapt legacy systems to these rules. Audits demand traceable logs, robust access controls, and policy enforcement.

Failing to align with these can result in operational disruptions and license suspensions. Many regulators now expect proactive compliance—a shift from reactive measures to embedded controls.

To keep pace, banks must implement a dynamic framework that evolves with regulatory updates.

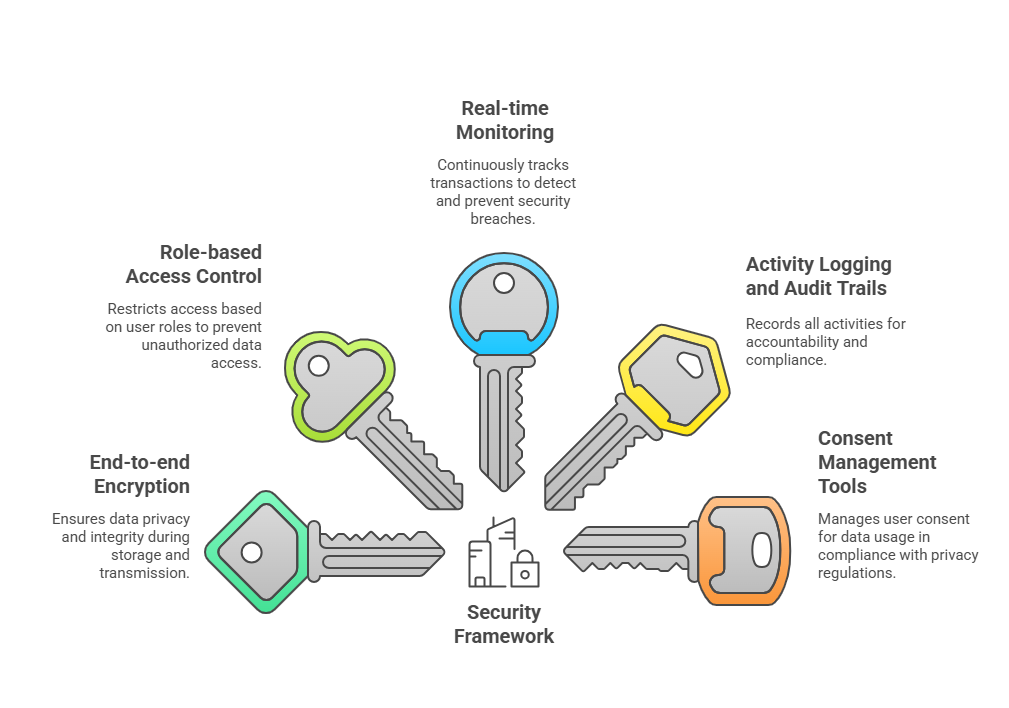

Key Technologies That Support Compliance Readiness

Technology plays a vital role in streamlining compliance. Key tools include:

These systems reduce manual workload, improve response times, and provide a scalable way to maintain audit-readiness.

Banks leveraging these technologies can also generate real-time dashboards, proving compliance during audits. This digital-first approach turns compliance into a business enabler, not just a cost center.

How to Build a Compliant Digital Banking Platform

Essential Features for Compliance

A compliant digital banking platform needs to be secure by design. Key features include:

User flows should align with legal expectations.

For example, onboarding flows should include mandatory KYC steps without adding friction and requirements must be mapped into the product architecture.

Integration with RegTech Solutions

To stay agile, digital banking platforms should integrate with RegTech APIs. This provides access to services such as:

- Sanctions list screening

- Automated regulatory reporting

- Fraud detection models

These integrations allow financial platforms to focus on growth without sacrificing compliance. They also speed up launch timelines by automating tasks that otherwise require legal reviews.

Using modular, compliant infrastructure reduces technical debt and enhances scalability.

Final Thoughts: Building Trust Through Compliance

Trust is the currency of digital banking. And trust is earned through transparency, security, and compliance.

As regulations grow more complex, banks that act proactively can turn compliance into a differentiator. This means investing in the right technologies, building with security in mind, and creating experiences that are both user-friendly and compliant.

For institutions at any stage of digital transformation, embedding compliance into the platform isn’t optional—it’s essential.

Avanza Solutions partners with banks and Fintechs to embed trust through secure, compliant digital ecosystems—empowering them to meet global regulatory standards while scaling innovation.