72% of Digital Transformations Fail — How Enterprises Can Avoid the Pitfalls

October 3, 2025The financial industry is undergoing a historic shift. Customers now expect seamless onboarding, instant responsiveness, hyper-personalization, and intelligent engagement across every touchpoint, from mobile to WhatsApp to branch banking.

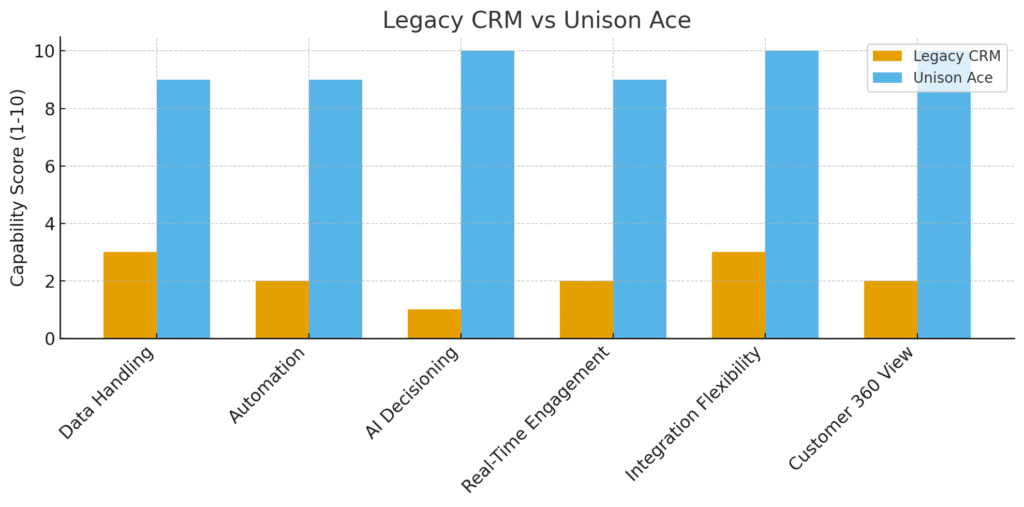

Unfortunately, most banks still rely on CRMs built as data repositories rather than as intelligence platforms. These systems were never designed for real-time decisions, omnichannel journeys, or agent augmentation, all of which define modern banking.

Unison Ace solves this gap. It is an AI-native CRM + CEM platform explicitly engineered for financial institutions to unify channels, orchestrate journeys, and deliver outcome-driven customer experiences at scale.

This newsletter explores why traditional CRMs fail, how AI-native systems outperform them, and how Unison Ace transforms banking functions end-to-end.

THE FAILURE OF LEGACY CRM IN BANKING

Banking CX now spans dozens of channels, mobile apps, branches, IVR, chatbots, WhatsApp, core systems, and payment systems. Yet legacy CRMs were never built to integrate or orchestrate this complexity.

Leading studies highlight the crisis:

- Deloitte (2023): 56% of banks report poor CX due to disconnected systems

- EY (2024): Legacy CRMs increase cost-to-serve due to manual processes

- Accenture: 68% of banking customers leave after repeated friction in service journeys

Top CRM failures include:

- Fragmented data → No real-time Customer 360

- Zero predictive intelligence → No Next Best Action

- Manual case handling → Slow journeys & rising customer frustration

- Rigid architecture → Unable to scale to new channels

Banks cannot deliver modern journeys (onboarding, loan processing, dispute resolution) with yesterday’s tools.

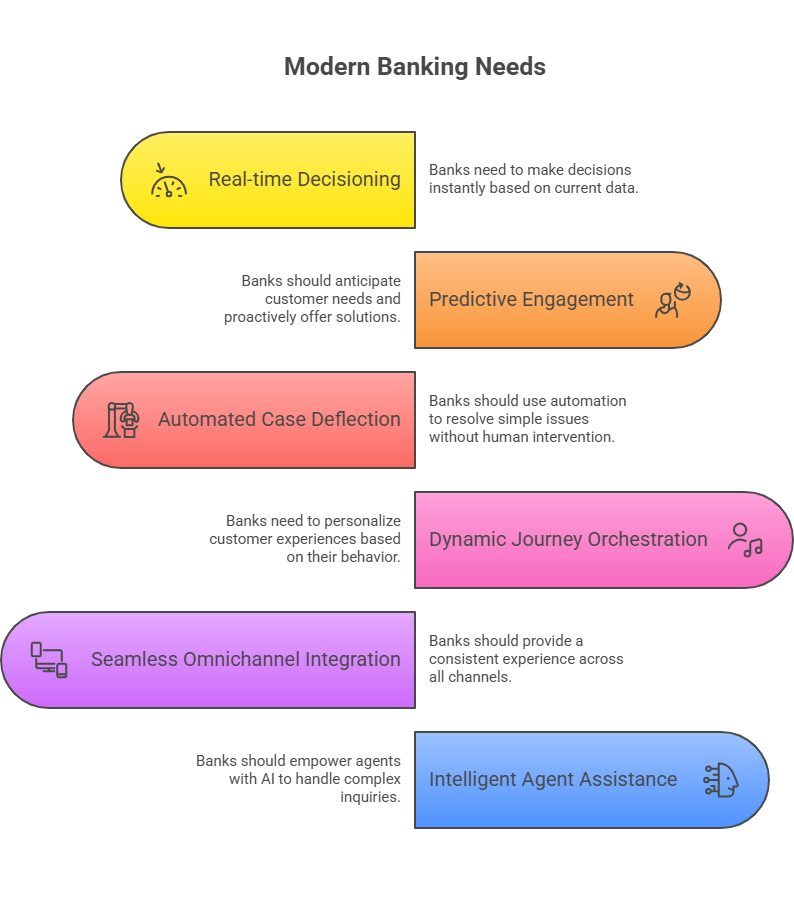

WHY BANKS NEED AN AI-NATIVE CRM

AI-native CRMs are fundamentally different from traditional platforms.

They analyze signals, detect sentiment, predict behavior, and automatically trigger optimized actions.

According to global research:

- McKinsey: Banks using AI see a 30–45% improvement in cross-sell

- Gartner: AI reduces operational load by up to 60%

- PwC: Intelligent automation increases CX satisfaction by 34%

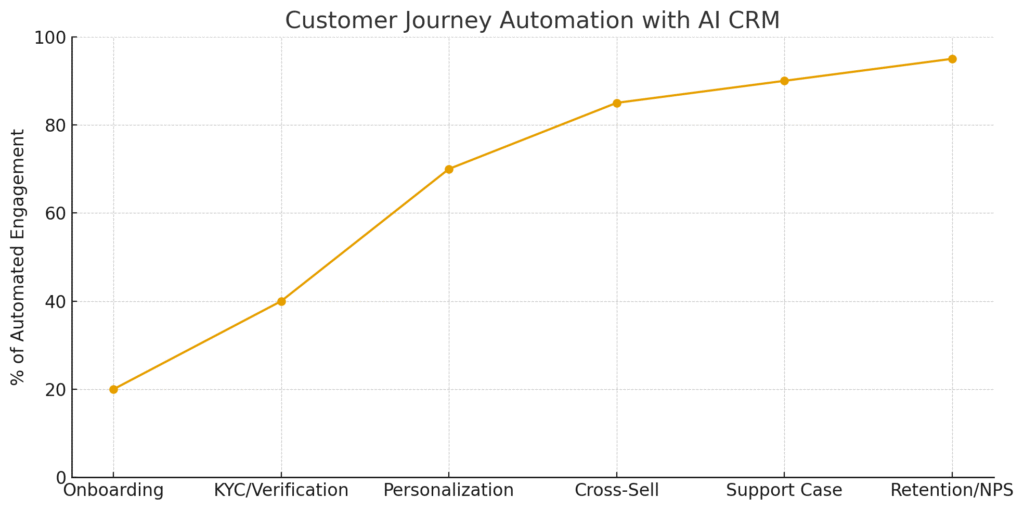

JOURNEY ORCHESTRATION REINVENTED

Unison Ace enables end-to-end orchestration for every banking journey:

- Customer onboarding & e-KYC

- Credit card applications

- Loan origination

- Dispute resolution

- Contact center routing

- Collections & retention flows

Unlike static CRMs, Unison Ace listens, thinks, and acts in real time:

- Detects customer intent

- Understands sentiment

- Pulls identity-resolved Customer 360

- Predicts outcomes with AI

- Triggers optimal decisions or actions

- Automates tasks across channels

WHAT MAKES UNISON ACE DIFFERENT

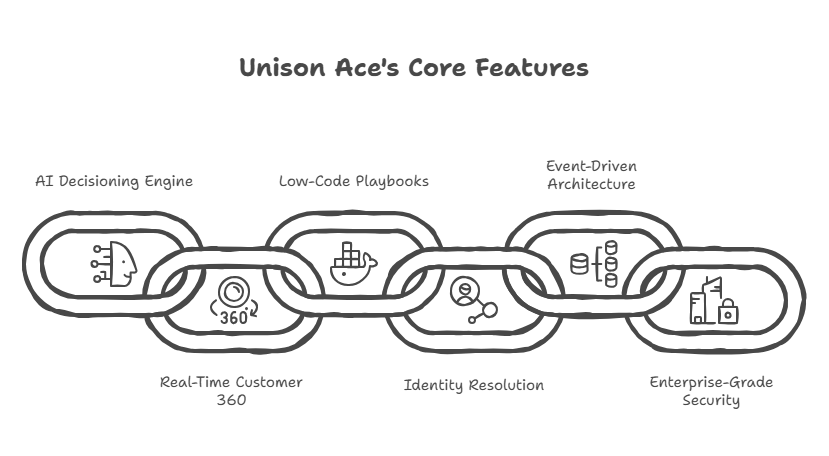

1. AI Decisioning Engine

Understands context, predicts outcomes, and triggers next-best-actions.

2. Real-Time Customer 360

Unifies profiles from core banking, mobile apps, IVR, WhatsApp, branches, and cards.

3. Low-Code Playbooks

Build outcomes like “increase retention,” “reduce AHT,” or “improve upsell.”

4. Identity Resolution

Links behavior across devices, phone numbers, apps, and sessions.

5. Event-Driven Architecture

Built for streaming data, webhook triggers, and large-scale bank workloads.

6. Enterprise-Grade Security

RBAC, encryption, auditability, policy enforcement, and data residency.

TRANSFORMATION ACROSS BANKING FUNCTIONS

Marketing Transformation

- AI-driven segmentation

- Micro-experiences

- Next Best Offer recommendation

- Cross-channel campaign automation

Sales Transformation

- Predictive lead scoring

- Smart conversion paths

- Intelligent follow-ups

- Opportunity intelligence

Service Transformation

- Case deflection

- Intelligent auto-routing

- Sentiment-based prioritization

- Agent assistance with recommended responses

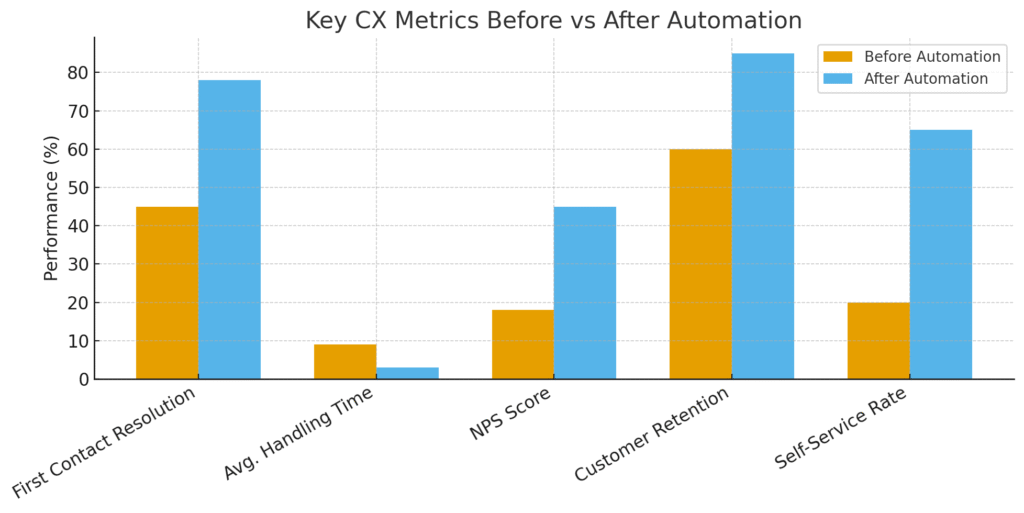

MEASURABLE IMPACT: THE NUMBERS THAT MATTER

Banks deploying Unison Ace consistently report:

- 42% faster case resolution

- 3× higher self-service adoption

- 38% increase in NPS

- 55% reduction in manual workload

- 2× improvement in customer retention

THE AI DECISIONING LAYER

The decisioning engine is the heart of Unison Ace.

It continuously learns from:

Every customer action becomes a signal that triggers smarter future engagement.

SECURITY, COMPLIANCE & RISK MANAGEMENT

Unison Ace meets strict banking-grade requirements:

- End-to-end encryption

- Zero-trust identity architecture

- Data residency compliance

- Role-based access control (RBAC)

- Full audit trails

- Multi-layer segregation

Built to meet the standards of PCI-DSS, ISO 27001, SBP guidelines, and GDPR.

CONCLUSION

The future of CRM in banking is AI-native, real-time, and outcome-driven. Traditional CRMs cannot keep up with today’s expectations. Banks need a platform that:

Unison Ace is that platform.

Banks that adopt AI-native CRM today will define the next decade of customer experience, operational efficiency, and digital leadership.